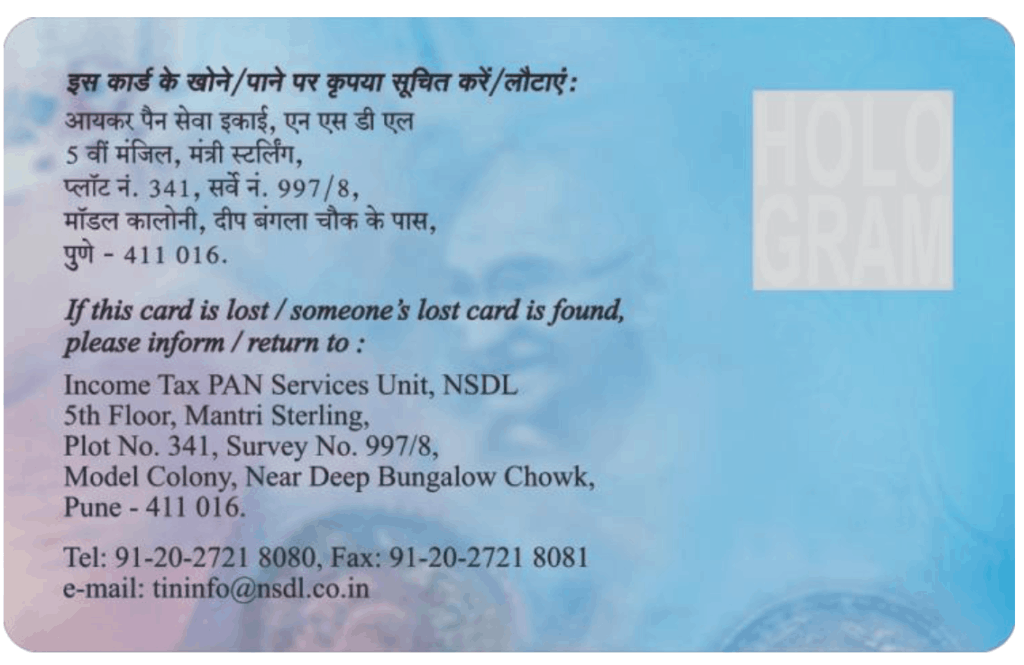

How to Download e-PAN Card Using NSDL Portal?Īpplicants who have applied from the NSDL website have the option to download e-PAN through the NSDL portal. The mobile number must be registered to the Aadhaar card.His or her Aadhaar card details must be up to date.He or she must be an individual taxpayer.What Are Conditions to Apply for an e-PAN Card? 10,000 may be imposed on a person who is found to have more than one PAN card. It is crucial to note that it is unlawful to have more than one PAN card. The e-PAN card contains the following information on the cardholder: Using your Aadhaar card, you can also instantly download a PAN. Through the NSDL or UTIITSL portal, you can download an e-PAN.

Your e-PAN, which you can store on your computer or smartphone, will have all your PAN information. A virtual PAN card that may be used for e-verification is known as an e-PAN card. Your physical PAN card is now available in digital format as an e-PAN card. In addition, one can download e-PAN card online, which can be used everywhere as an identity-proof document. Within 45 days of application, the PAN card hardcopy is delivered to the address provided on Form 49A. Through the UTIITSL or NSDL websites, one can submit an application for a PAN card. Any tax-paying entity, whether an individual or an organisation, must have a PAN card. The process for e-PAN does not involve paperwork and does not have any fee at the moment.A permanent Account Number is a 10-digit alphanumeric number that is given to each individual who pays taxes and every company conducting financial operations in India. It is to note that the size should not exceed 10KB and should be in JPEG format.Į-PAN facility is available for all those who have an Aadhaar number issued by UIDAI and have to file Form 49A for PAN. Signature and a scanned photograph of the applicant should be uploaded.Applicant’s Aadhaar should have a valid mobile number registered.Anyone filing for an e-PAN needs to have Aadhaar based e-KYC.The Unique Identification Authority of India (UIDAI)’s KYC is leveraged by the IT Department and rolls out instant allotment of e-PAN.

0 kommentar(er)

0 kommentar(er)